Small Claims Court UK: A Complete Beginner's Guide

The small claims court UK system is a section of the county court designed to deal with lower-value civil disputes quickly, simply, and at a lower cost than traditional litigation. Its purpose is to make justice accessible for individuals, freelancers, landlords, tenants, and small businesses without the need for expensive solicitors.

What is the Small Claims Court in the UK?

Modern tools like CaseCraft.AI – small claims court UK online service now make this process even easier by helping people file or defend claims without needing a lawyer.

In England and Wales, the small claims track usually applies to cases worth up to £10,000. The process is designed to be less formal, meaning you can often represent yourself without needing a barrister. In Scotland, the limit is £5,000, and in Northern Ireland, it is £3,000. The rules differ slightly in each jurisdiction, so it is important to confirm the details for your specific region.

Typical disputes handled in the small claims court include:

- Unpaid invoices or wages

- Refunds for faulty products or poor services

- Disputes between landlords and tenants (eg, withheld deposits)

- Minor road traffic accidents and property damage

- Breach of contract involving small amounts of money

By keeping the process straightforward and affordable, the small claims track ensures that justice is not limited to those with significant financial resources.

When should you use the small claims court?

Not every dispute is suitable for the small claims process. Generally, you should consider it if:

- The amount in question is relatively small (under the jurisdictional limit).

- The case is simple and does not require lengthy expert testimony.

- You want to avoid high legal fees that would outweigh the potential recovery.

- You are comfortable representing yourself with minimal guidance.

For example, if you're a freelance designer who hasn't been paid £1,200 for a completed project, the small claims court is often the fastest way to enforce your rights. Similarly, a tenant who has had a £700 deposit unfairly withheld by a landlord can seek justice via this route.

Cases involving medical negligence, personal injury (over £1,000), or complex contractual disputes are usually unsuitable for the small claims track and may require formal legal representation.

Step-by-step process of filing a claim

Filing a claim is a structured process, but it has been made easier in recent years thanks to online services. Here's a breakdown:

- Attempt to resolve the issue first

Send a letter before action, outlining your claim and a deadline for payment. - Check eligibility

Confirm that your case fits within the small claims track. - File your claim

In England and Wales, this can be done online via Money Claim Online (MCOL) or using paper forms (Form N1). - Pay the court fee

Fees range from £35 to £455 depending on the claim amount, with possible reductions for low income. - Defendant's response

The defendant has 14 days to admit, dispute, or counterclaim. - Mediation and settlement

The court encourages use of the Small Claims Mediation Service. - Court hearing (if required)

If no settlement is reached, a judge will decide the case, often via telephone or video. - Judgment and enforcement

If you win and the defendant does not pay, enforcement options are available (bailiffs, attachment of earnings, etc.).

Common mistakes to avoid

- Not keeping records - contracts, invoices, messages, and receipts are essential.

- Overstating claims - unrealistic amounts may harm credibility.

- Missing deadlines – strict time limits apply.

- Skipping mediation – judges expect attempts at resolution.

- Poor preparation – even informal hearings require clear arguments.

How technology simplifies small claims in the UK

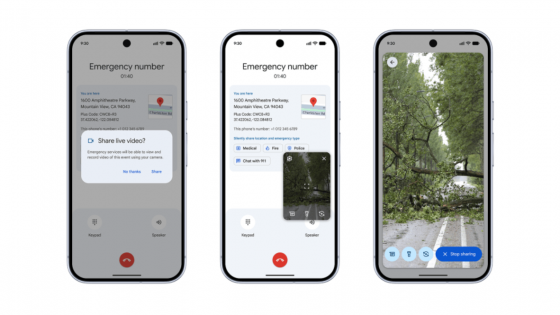

For decades, the small claims process was associated with paperwork, confusing forms, and strict procedural rules. Today, digital services and AI-powered platforms reduce errors, track deadlines, and simplify document preparation. These tools make justice more accessible, particularly for those who cannot afford a solicitor.

Frequently Asked Questions

How long does a small claim take in the UK?

Most cases are resolved within a few months, although complex ones may take longer.

Can I claim interest on money owed?

Yes, statutory interest at 8% per year can be added to unpaid amounts.

Do I need a lawyer?

Well, the process is designed for self-representation.

What happens if I lose?

You may pay limited costs to the other party, but usually much less than in higher courts.

Can businesses use small claims court?

Yes, SMEs frequently recover unpaid invoices this way.

Conclusion

The small claims court UK system offers an accessible, affordable path to justice for everyday disputes. Whether you're a freelancer chasing an unpaid invoice, a tenant disputing a deposit, or a small business enforcing a contract, the process is designed to be user-friendly. By preparing carefully and using the tools available, you can significantly improve your chances of success.