RAM, SSD and graphics card prices are rising again, what's going on?

The reason behind this is not a "conspiracy theory of manufacturers", although they have been punished for this in the past, but a combination of a global shortage of memory chips, aggressive demand from data centers for artificial intelligence (AI), and deliberate production cuts by the largest manufacturers.

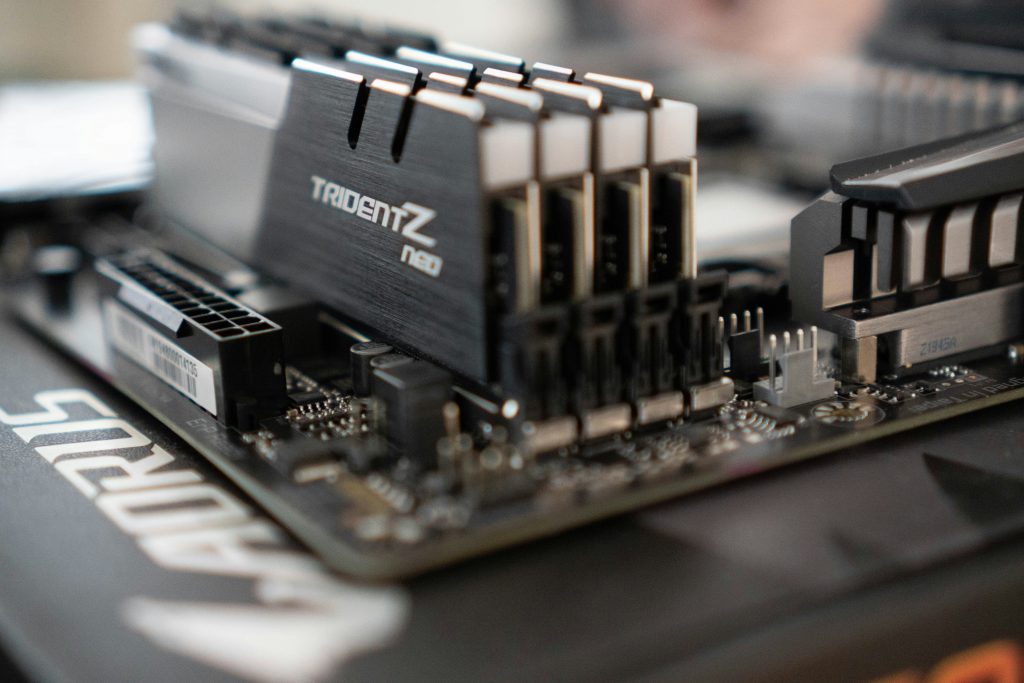

Double-digit RAM price increases, pri DRAM is even worse

TrendForce analytics house In November, it revised its DRAM price forecasts upward again in Q4 2025. Instead of the previously expected +8 to 13 % quarterly growth, they now expect +18 to 23 % in Q4 2025, with DDR5 in particular standing out, for which individual scenarios even mention 30 to 50% jumps by quarter (for the first half of 2026).

More mainstream sources also confirm that the predictions are already translating into real prices. According to Tom's Hardware, DRAM prices have risen to 50 % in the last quarter of 2025, with large suppliers in the US and China only getting around 70 % of ordered quantities, and smaller manufacturers and retailers getting significantly less.

One of the key reasons is that the largest manufacturers (Samsung, SK hynix, Micron) are increasingly shifting more capacity to HBM (High Bandwidth Memory) modules for AI accelerators, which reduces the available quantities of classic DDR5 for PCs and servers. SK hynix, for example, revealed that it has sold practically all of its DRAM, NAND, and HBM by the end of next year.

In a separate report, Reuters noted that Samsung has seen memory chip prices increase by up to 60% since September, further confirming that the market has turned from a phase of oversupply to a distinctly selling market.

DDR4 RAM is also subject to current market volatility. DDR4 modules have also become more expensive, but part of the reason for the price increase is the gradual discontinuation of production of the older generation of memory modules and the transition to DDR5.

For European buyers, this means that wholesale prices for DDR5 modules purchased by OEMs (companies that assemble or manufacture end products and therefore buy components in large quantities) and distributors are already significantly higher. Retail price increases always come with a slight delay, but even a blind person can see that prices are rising sharply.

SSDs: NAND is in a slump, prices are already jumping in Europe

The picture is similar for flash memory (NAND), the material from which SSDs are built. TrendForce predicts that contractual NAND prices will increase by an average of 5 to 10% in the fourth quarter of 2025 as manufacturers reduce or slow production expansion. Among other things, they point out that SanDisk has already announced a 10-10% price increase, while Micron has temporarily suspended the release of new price lists.

The TrendForce report warns that the largest NAND manufacturers have further reduced production in the second half of 2025, driving double-digit price growth and setting the stage for a further jump in the first quarter of 2026.

This is already being seen very concretely in European markets. A Spanish portal that monitors the local IT market reports a rapid jump in SSD prices in Spain due to a shortage of NAND memory, predicting that prices will continue to rise in the coming months.

The current forecast is that wholesale NAND prices will increase by an additional 5-10% by the end of the year. Consumer SSDs are already on average 10% more expensive, mostly in higher capacity and speed models. Server-grade SSDs are seeing even greater price increases.

Some mini PC manufacturers, such as Minisforum, have therefore officially announced price increases for all models that include DDR5 and SSD, while "barebone" versions without these components remain cheaper, which is a very clear sign that the bottleneck is precisely in the memory chips.

The situation in Europe is not yet as critical as in the US and other markets. We have compared prices in recent months and for now the difference in Europe is only a few percent, or we can say that it is part of normal market fluctuations. However, this can change very quickly, just like it has elsewhere.

More expensive memory, more expensive graphics cards

Although graphics cards are not labeled as memory products on the shelf, their production is almost entirely dependent on the prices of VRAM, especially GDDR6 and GDDR6X, and the broader situation in the DRAM and NAND markets. When hardware manufacturers are faced with more expensive memory, this inevitably translates into higher costs for manufacturing graphics cards.

Some European markets (Spain, France, etc.) have already issued initial announcements that the Radeon RX 9000 series could see its prices increase due to rising system and video memory prices. Local media reports that retailers are feeling the lag of the global DRAM price spike, first in RAM modules and now in graphics cards, where VRAM costs are directly reflected in the final retail price.

As mentioned above, the main reason is primarily the shift to HBM memory production, which means higher profits for the manufacturer. Since these contracts are always long-term, we can expect the consumer segment to be an afterthought for manufacturers for quite some time.

The result is additional pressure on GPU (graphics processor) prices, especially in the upper mid-range and premium segments, where margins are high enough that manufacturers can easily pass on the additional costs to end customers.

The price frenzy from the pandemic will most likely not be repeated, but we should not expect any significant price drops either. Prices will most likely gradually increase.

Why now and when will it get better?

We have barely recovered from the pandemic, and the consumer is once again at the mercy of the largest manufacturers and their whims. OpenAI, Meta, Microsoft, Nvidia, AMD, Amazon ... practically every company needs, plans or is already building additional data server capacities for the needs of AI development. Billions, trillions are being invested, and the consumer market will get the leftovers.

Another important reason is the strategy of memory manufacturers. The last two years have seen RAM and SSD prices being too consumer-friendly, with oversupply and overstock, leading manufacturers to agree to more conservative production. Trendforce's analysis found a gradual decline in output and a greater degree of caution in investments, which is keeping prices artificially high.

The optimistic forecast for the period when prices and production are expected to stabilize is the second quarter of 2026. Until then, we must be prepared for manufacturers of devices that require memory to announce price increases shortly, just as Xiaomi has already done in China with the Redmi K90 series of phones. The latter is known in our country as POCO.

We recommend that you check if you will need RAM, SSD soon, or maybe you have been planning to upgrade your graphics card for some time. Of course, the situation on the market can change quickly, but for now everything points to significant price increases and this may be the last moment to make the replacement at the "normal" price.

The tables show price changes in recent months on the European market.

| RAM | 15. 9. 2025 (€) | 15. 10. 2025 (€) | 14. 11. 2025 (€) | Change since September |

| Patriot Viper VENOM 32GB DDR5 | 86,89 | 99,94 | 199,00 | +129,03 % |

| Corsair Vengeance RGB 32GB DDR5 | 125,99 | 154,00 | 232,46 | +84,51 % |

| Kingston FURY Beast 32GB DDR5 | 113,90 | 132,90 | 192,15 | +68,70 % |

| Crucial Pro Overclocking 32GB DDR5 | 83,69 | 89,99 | 159,99 | +91,17 % |

| G.Skill Trident Z5 NEO RGB 32GB DDR5 | 121,62 | 154,90 | 269,00 | +121,18 % |

| G.Skill Flare X5 32GB DDR5 | 111,51 | 124,99 | 239,00 | +114,33 % |

| Kingston FURY Beast RGB 32GB DDR5 | 135,59 | 136,99 | 204,19 | +50,59 % |

| Kingston FURY Beast 64GB DDR5 | 212,90 | 263,85 | 368,99 | +73,32 % |

| Corsair Vengeance 32GB DDR5 | 117,89 | 130,99 | 212,90 | +80,59 % |

| Corsair Vengeance RGB 64GB DDR5 | 244,98 | 258,37 | 439,00 | +79,20 % |

| G.Skill Aegis 32GB DDR4 | 68,89 | 77,90 | 141,90 | +105,98 % |

| TeamGroup T-Create Expert 32GB DDR5 | 99,89 | 118,64 | 195,00 | +95,21 % |

| SSD | 15. 9. 2025 (€) | 15. 10. 2025 (€) | 14. 11. 2025 (€) | Change since September |

| Samsung SSD 990 EVO Plus 2TB | 122,01 | 123,95 | 129,99 | +6,54 % |

| Samsung SSD 990 PRO 2TB | 145,99 | 159,75 | 169,95 | +16,41 % |

| Samsung SSD 990 PRO 4TB | 284,89 | 269,99 | 289,00 | +1,44 % |

| Samsung SSD 990 EVO Plus 1TB | 74,99 | 74,90 | 80,00 | +6,68 % |

| Samsung SSD 990 EVO Plus 4TB | 239,88 | 243,99 | 248,99 | +3,80 % |

| Samsung SSD 9100 PRO 2TB | 216,82 | 219,99 | 229,99 | +6,07 % |

| Lexar NM790 2TB | 115,73 | 119,90 | 137,94 | +19,19 % |

| Lexar NM790 4TB | 222,98 | 222,99 | 257,72 | +15,58 % |

| Kingston NV3 NVMe PCIe 4.0 1TB | 49,90 | 55,90 | 66,90 | +34,07 % |

| KIOXIA Exceria Plus G3 2TB | 101,90 | 104,89 | 112,99 | +10,88 % |

| WD_BLACK SN850X 2TB | 144,97 | 142,99 | 149,99 | +3,46 % |

| WD_BLACK SN7100 2TB | 117,89 | 118,25 | 126,09 | +6,96 % |